2024 turned into a much stronger year for the housing market than many anticipated, with a return to house price growth. This year looks set to continue in a very similar way with continued stronger levels of market activity and solid price growth.

Economic growth expectations

Whilst economic growth expectations have moderated a little for 2025 (the Bank of England recently cut its GDP forecast for the year to 0.75%), the economy is still expected to grow and growth levels should be sufficient to drive moderate house price growth. Beyond 2025, current economic forecasts point to stronger year next year, with economic growth momentum picking up speed. With a few conflicting signals the Bank of England will likely take a slow and measured approach to further interest rate cuts, but forecasts suggest there is scope for further rate cuts. The consensus forecast for year end is 3.75%.

Sales volumes recovery

Sales volumes suffered through much of 2023 and early 2004, what is evident now in the market is a recovery to normal levels of activity. The latest month sales volume for the UK* reported 88,200 monthly sales – broadly in line with the levels of activity in the market for the 5 years prior to covid. Mortgage approvals, which are the front runner to transaction activity, have also recovered to long-term trend levels. Latest monthly data** was 66,500 exactly the same as the monthly average for the 5 years to end 2019 (pre covid).

Market activity

January activity levels are certainly much stronger than a year ago. The number of new sellers coming to market was 13% ahead, buyer demand 8% ahead, and sales agreed numbers up by 15% according to Rightmove data. Additionally, the RICS leading indicator for prices has been at its strongest level for the last 3 months since the Truss mini budget in September 2022. First-time buyers have an extra motive to get on with their transactions, with the reversal in the stamp-duty exemption now looming close at the end of March.

Shifting market dynamics

Buyer confidence appears to be continuing to grow. In a recent poll, 62% of agents think that buyer confidence has slightly or significantly improved compared to 3 months prior*. However, the positive impact of improvements in buyer activity have been tempered slightly by extra supply for sale coming onto the market – keeping price growth low in some geographies. In fact, Rightmove data suggests that the national supply of homes for sale is at a 10 year high.

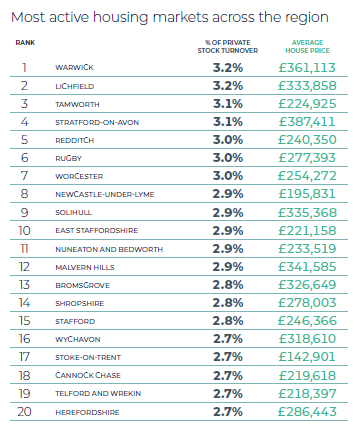

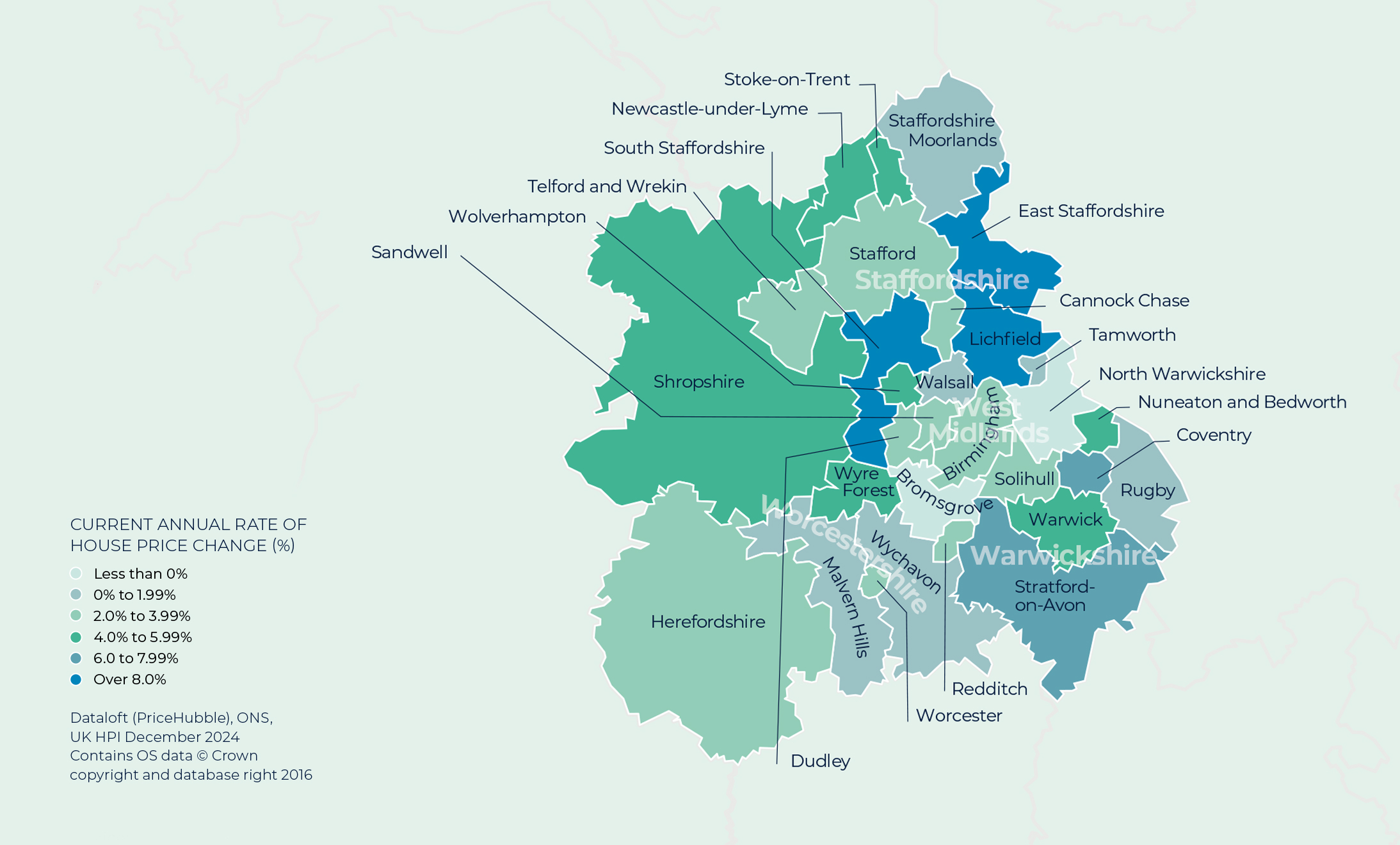

Average property values in the West Midlands are up 4.2% on last year’s levels. Strongest price growth was evident in Lichfield, and also South and East Staffordshire, where in each prices increased by over 8%.

*Dataloft by PriceHubble, poll of subscribers

Cash sales

With the recovery in mortgage lending in 2024, the proportion of cash sales (those not requiring a mortgage) has also fallen back to more typical levels. Through 2023, when mortgage lending fell, the proportion of cash sales rose to a cyclical peak of 34%. For the 5 years prior to that the average was 28%. In 2024, the proportion of cash deals fell back to 31% and will likely fall back further in 2025 towards the long-term average. 30% of West Midlands sales in the last year were cash transactions.

Contact us

Sell your property with your local expert this season. Contact your local Guild Member today.